Why Do Businesses Need Loans?

Businesses search loans for numerous reasons. Among the most common are money flow administration, capital expenditures, and progress alternatives.

Why Do Businesses Need Loans?

Businesses search loans for numerous reasons. Among the most common are money flow administration, capital expenditures, and progress alternatives. When a company experiences seasonal fluctuations, a enterprise mortgage may help bridge the hole till income streams stabilize. Additionally, investing in tools or facility upgrades often requires bigger sums that a enterprise won't have availa

How to Choose the Right Loan

Selecting the proper business loan includes several key considerations. Begin by evaluating your specific needs. Assess how a lot money you require and the aim of the loan — whether or not it’s for gear purchase, operational costs, or expans

n The time to get approval for a business mortgage can vary extensively. Traditional loans may take a number of weeks as a outcome of comprehensive evaluations, while different lenders usually provide quicker responses, typically inside a couple of days. It’s clever to have all necessary documentation able to doubtlessly pace up the met

Understanding the world of business loans is essential for entrepreneurs looking for to fund their ventures. Business loans function a financial lifeline that may allow small to massive companies to thrive, increase, or simply preserve their operations. The proper loan can provide the mandatory capital to invest in equipment, rent extra staff, or transfer into a larger house. However, navigating the myriad of options obtainable may be overwhelming, which is why sources like Be픽 turn out to be invaluable. This site provides thorough evaluations and details on various business loan options, helping customers make informed selections for their monetary ne

Exploring 베픽 for

Loan for Office Workers Information

In the realm of economic services, 베픽 stands out as a priceless platform for those in search of info concerning unemployed loans. The web site offers complete reviews and detailed insights, guiding users in their decision-making course

What Are Business Loans?

Business loans are funds borrowed by firms from banks or monetary institutions that must be paid back over time with interest. Typically, these loans may be utilized for numerous functions similar to buying stock, equipment, and even real property. Depending on the lender and the specific terms, the quantities, repayment schedules, and interest rates can considerably ra

The Application Process

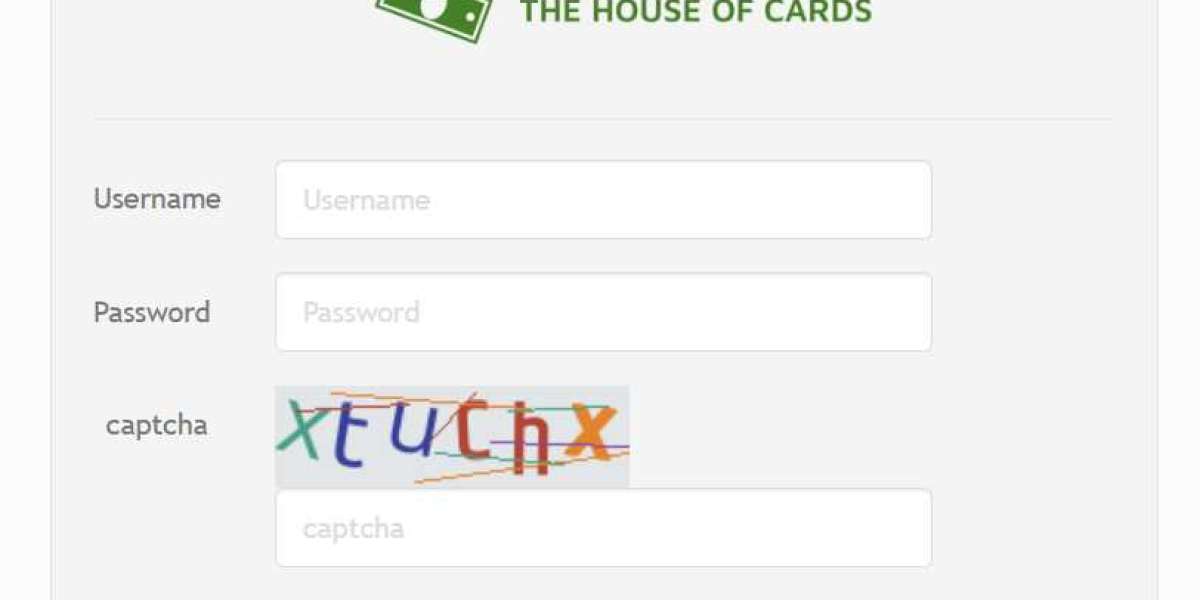

The software course of for a enterprise loan can differ considerably from lender to lender. Typically, the method begins with submission of an software kind. You'll want to offer details about your small business, your financial situation, and the aim of the l

Additionally, individuals ought to explore all out there sources to help during unemployment earlier than opting for loans. Sometimes, government help or community packages could present Highly recommended Web-site help with out the necessity for d

Next, contemplate the cost of the

Loan for Day Laborers. Look beyond simply the interest rate; calculate the entire reimbursement amount, including fees and other costs that may be involved. This will help you understand the true price and decide if it matches within your bud

There are a quantity of forms of enterprise loans available, together with time period loans, traces of credit, and invoice financing, every tailor-made to swimsuit completely different monetary wants. Understanding these distinctions is essential for companies to choose probably the most suitable loan sort for their scenario

Highly recommended Web-site. Moreover, the application process can range from relatively simple to advanced, depending on the lender's requireme

Lines of Credit: Unlike term loans, lines of credit provide access to funds as a lot as a sure limit. This flexible option allows business house owners to withdraw money as wanted, solely paying curiosity on the amount borro

n Same-day loans may be safe if sourced from respected lenders. It's essential to conduct thorough research on lenders, read critiques, and perceive the terms earlier than borrowing. Awareness of your monetary obligations also contributes to a safer borrowing experie

Visitors to 베픽 can discover articles outlining the professionals and cons of unemployed loans, comparisons of various lenders, and user experiences. This wealth of data empowers individuals to make confident choices about their monetary futu

This centralized approach not only saves borrowers time but in addition empowers them to navigate the often difficult lending panorama with confidence. Bepick successfully demystifies the mortgage course of, placing important information at the users' fingert

Finally, pay consideration to the application process. Some lenders provide a quick and seamless course of, while others might require intensive documentation. The ease with which you may find a way to apply can significantly influence your general expert

Benefits of Business Loans

Utilizing a business mortgage can provide numerous benefits. Firstly, it provides instant capital, which may be important for sustaining operational stability. A well-timed loan can help guarantee that you've the necessary funds for stock, employee salaries, or crucial bi

Unlocking the World of Online Betting with Casino79: Your Ultimate Scam Verification Platform

Par windychristman Диплом с внесением в реестр.

Par anjaduong0182

Диплом с внесением в реестр.

Par anjaduong0182 Внести диплом в реестр.

Par mavisstepp3646

Внести диплом в реестр.

Par mavisstepp3646 Купить диплом с реестром в россии.

Par orvillepokorny

Купить диплом с реестром в россии.

Par orvillepokorny Купить диплом с занесением в реестр стоимость.

Par kindraberke38

Купить диплом с занесением в реестр стоимость.

Par kindraberke38